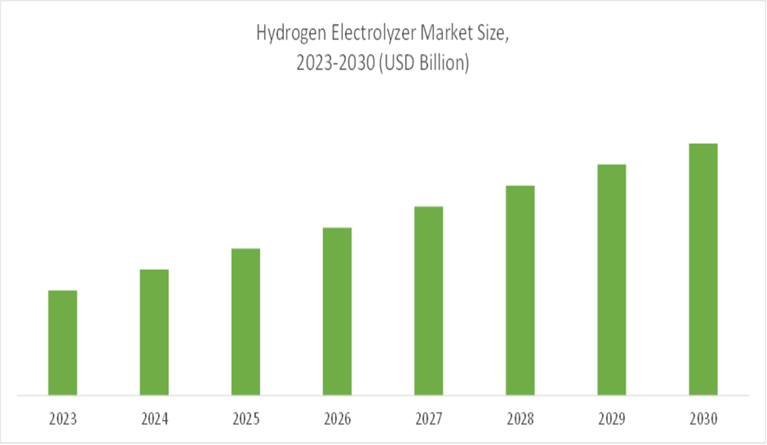

The size of the global hydrogen electrolyzer market reached USD 2.0 billion in 2023 and is projected to exceed USD 10.0 billion by 2030, demonstrating a growth rate of more than 25.8% from 2024 to 2030.

Market Definition:

A hydrogen electrolyzer is a device that uses electrical energy to split water (H2O) into its constituent elements, hydrogen (H2) and oxygen (O2), through a process called electrolysis. It consists of an electrolyte solution, typically alkaline or proton exchange membrane (PEM), and two electrodes—an anode and a cathode—immersed in the electrolyte. When an electric current is passed through the water, hydrogen gas is generated at the cathode, while oxygen gas is produced at the anode. The hydrogen produced through electrolysis can be used as a clean energy carrier for various applications, including fuel cells, industrial processes, and transportation.

Hydrogen Electrolyzer Market Drivers and Trends:

Growing Adoption of Green Hydrogen Drives Expansion in Electrolyzer Market

With increasing global emphasis on decarbonization and renewable energy integration, the hydrogen electrolyzer market is witnessing a significant trend towards the adoption of green hydrogen production methods. Green hydrogen, produced through electrolysis using renewable energy sources such as solar and wind power, is gaining traction as a clean and sustainable alternative to conventional fossil fuel-based hydrogen production methods.

This trend is driven by various factors, including declining costs of renewable energy technologies, supportive government policies and incentives promoting clean hydrogen production, and growing corporate commitments to carbon neutrality. As countries and industries strive to reduce their carbon footprint and transition towards a low-carbon economy, the demand for green hydrogen and electrolyzer systems is expected to surge.

Furthermore, partnerships and collaborations among key industry players, energy companies, and technology providers are facilitating the development and deployment of large-scale electrolyzer projects. These initiatives aim to scale up electrolyzer manufacturing capacity, improve efficiency, and reduce costs to make green hydrogen competitive with conventional hydrogen production methods.

Thus, the growing adoption of green hydrogen as a key enabler of sustainable energy systems is driving expansion and innovation in the hydrogen electrolyzer market, positioning electrolysis technology as a vital component of the clean energy transition.

Emerging Applications Propelling Hydrogen Electrolyzer Market Growth

One driving factor of the hydrogen electrolyzer market is the emergence of new applications for hydrogen. As industries and sectors seek cleaner and more sustainable energy solutions, hydrogen is increasingly being recognized as a versatile energy carrier with diverse applications.

Emerging applications such as hydrogen fuel cell vehicles, grid balancing, energy storage, and industrial processes present significant opportunities for the hydrogen electrolyzer market. Hydrogen fuel cell vehicles, for example, offer zero-emission transportation solutions and are gaining traction in automotive markets worldwide. Grid balancing and energy storage applications involve using hydrogen as a means to store excess renewable energy generated from sources like solar and wind power, helping to stabilize the electricity grid and improve energy resilience.

Moreover, hydrogen is being utilized in various industrial processes, including refining, chemical manufacturing, and steel production, as a clean alternative to fossil fuels. As industries transition towards decarbonization, the demand for hydrogen as a feedstock and energy source is expected to rise, driving the adoption of electrolyzers for hydrogen production.

Therefore, the emergence of new applications for hydrogen presents a significant driving force for the hydrogen electrolyzer market, as it expands the potential markets and use cases for hydrogen production, accelerating the deployment of electrolysis technology.

Hydrogen Electrolyzer Market Restraints and Challenges:

High Initial Capital Investment Hindering Market Growth

A notable challenge in the hydrogen electrolyzer market is the considerable initial capital investment needed to establish electrolysis facilities. While hydrogen electrolysis offers a promising pathway for green hydrogen production, the upfront costs associated with procuring electrolyzer systems, infrastructure development, and site preparation can be substantial. The capital investment includes not only the electrolyzer itself but also ancillary equipment such as power conversion systems, water treatment facilities, and hydrogen storage solutions.

Moreover, the costs vary depending on the type and size of the electrolyzer technology chosen, with newer and more efficient technologies often commanding higher prices. Additionally, the need for specialized engineering expertise and regulatory compliance further escalates project expenses. This high capital barrier poses a challenge for potential investors and project developers, especially in regions where government incentives or supportive policies for hydrogen infrastructure development are lacking.

Consequently, the capital-intensive nature of hydrogen electrolyzer projects can deter widespread adoption and hinder market growth, particularly in the early stages of industry development. Addressing this restraint requires innovative financing mechanisms, supportive government policies, technological advancements leading to cost reductions, and collaboration among industry stakeholders to accelerate the transition towards cost-competitive green hydrogen production.

Infrastructure Development Constraints

One of the significant challenges facing the hydrogen electrolyzer market is the constraint associated with infrastructure development. While the demand for clean hydrogen continues to rise, the establishment of a robust infrastructure to support the production, storage, transportation, and distribution of hydrogen remains a considerable obstacle. Building this infrastructure requires substantial investment and coordination among stakeholders, including governments, industry players, and investors.

Infrastructure development encompasses several aspects, including the establishment of hydrogen production facilities, such as electrolyzer plants, and the creation of hydrogen refueling stations for transportation applications. Additionally, the deployment of pipelines or other transportation methods for bulk hydrogen delivery to end-users is crucial. Furthermore, ensuring the safety and regulatory compliance of hydrogen infrastructure adds another layer of complexity.

Overcoming infrastructure development constraints requires proactive measures such as policy support, financial incentives, and public-private partnerships to accelerate investment and deployment. Collaboration among governments, industry stakeholders, and research institutions is essential to address regulatory barriers, optimize technology deployment, and streamline permitting processes. By addressing these challenges, the hydrogen electrolyzer market can unlock its full potential to support the transition towards a sustainable and decarbonized energy future.

Segmental Overview

The hydrogen electrolyzer market is segmented into type, capacity, end-user and region.

Hydrogen Electrolyzer Market by Type

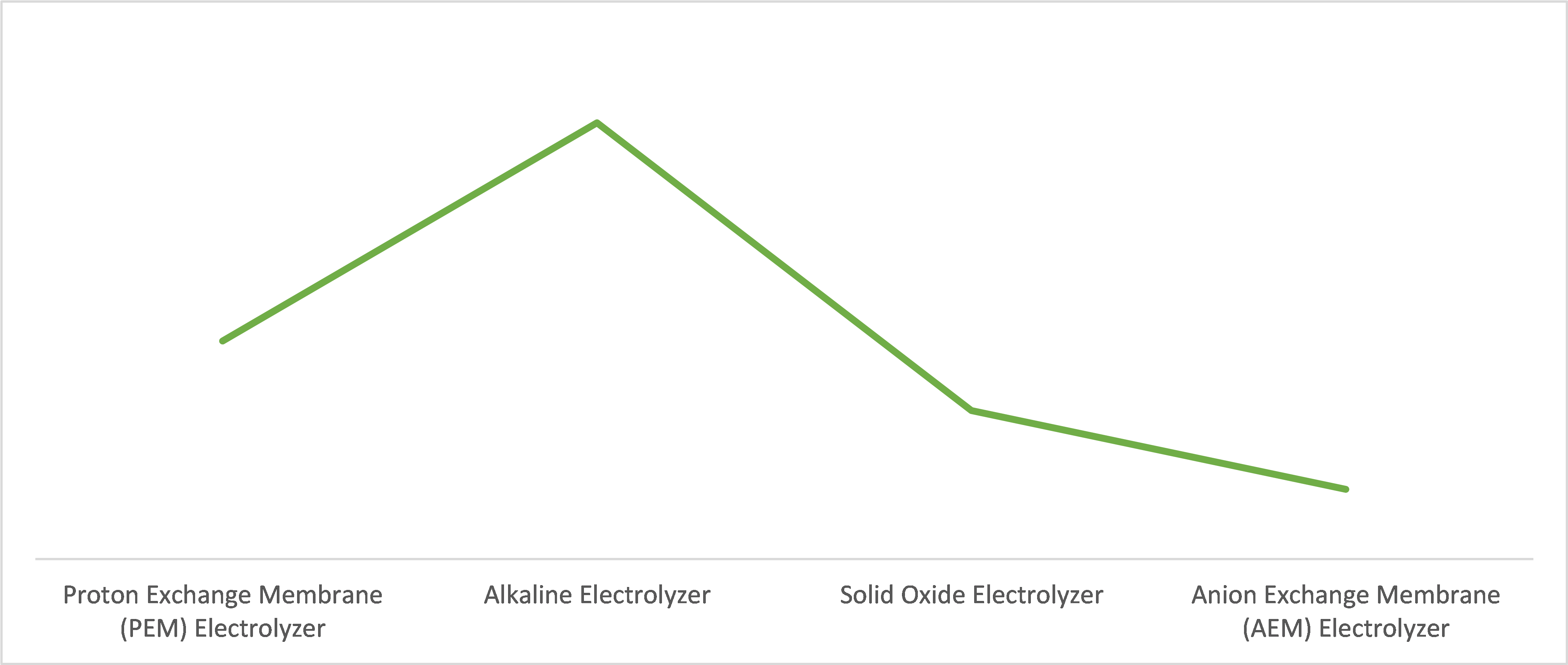

By type, the market is segmented into proton exchange membrane (PEM) electrolyzers, alkaline electrolyzers, and solid oxide electrolyzers. The alkaline electrolyzer segment held the largest market in the hydrogen electrolyzer market share in 2023, while the proton exchange membrane (PEM) electrolyzer category is projected to experience the most rapid growth during the forecast period. Additionally, alkaline electrolyzers are notably cheaper than PEM electrolyzers. Consequently, they are frequently employed for on-site hydrogen generation. One primary advantage of alkaline electrolyzers is their ability to support larger megawatt (MW) scale stacks, leading to enhanced capacity and a more stable operational environment for hydrogen electrolyzers.

Hydrogen Electrolyzer Market by Capacity

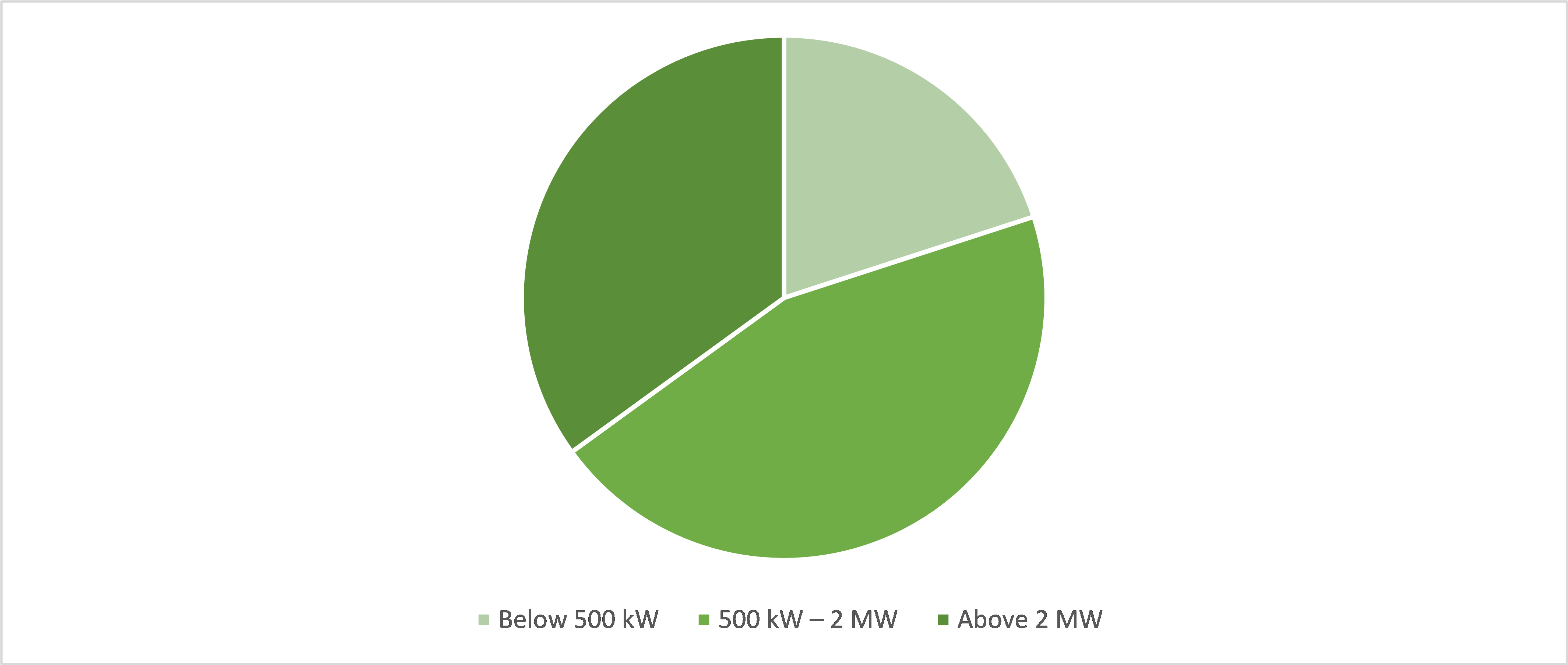

By capacity, the market is divided into below 500 kW, 500 kW–2 MW, and above 2 MW. The 500 kW–2 MW segment held the largest market share in 2023, with the above 2 MW segment expected to exhibit the highest growth rate during the forecast period. Furthermore, the demand for hydrogen electrolyzers with capacities ranging from 500 kW to 2 MW is considerable due to their suitability for on-site deployment and their ability to generate sufficient power and hydrogen. This hydrogen is then utilized as industrial energy or feedstock. Many enterprises prefer to integrate medium-sized electrolyzers into their facilities for hydrogen production, citing the additional advantage of reduced carbon emissions.

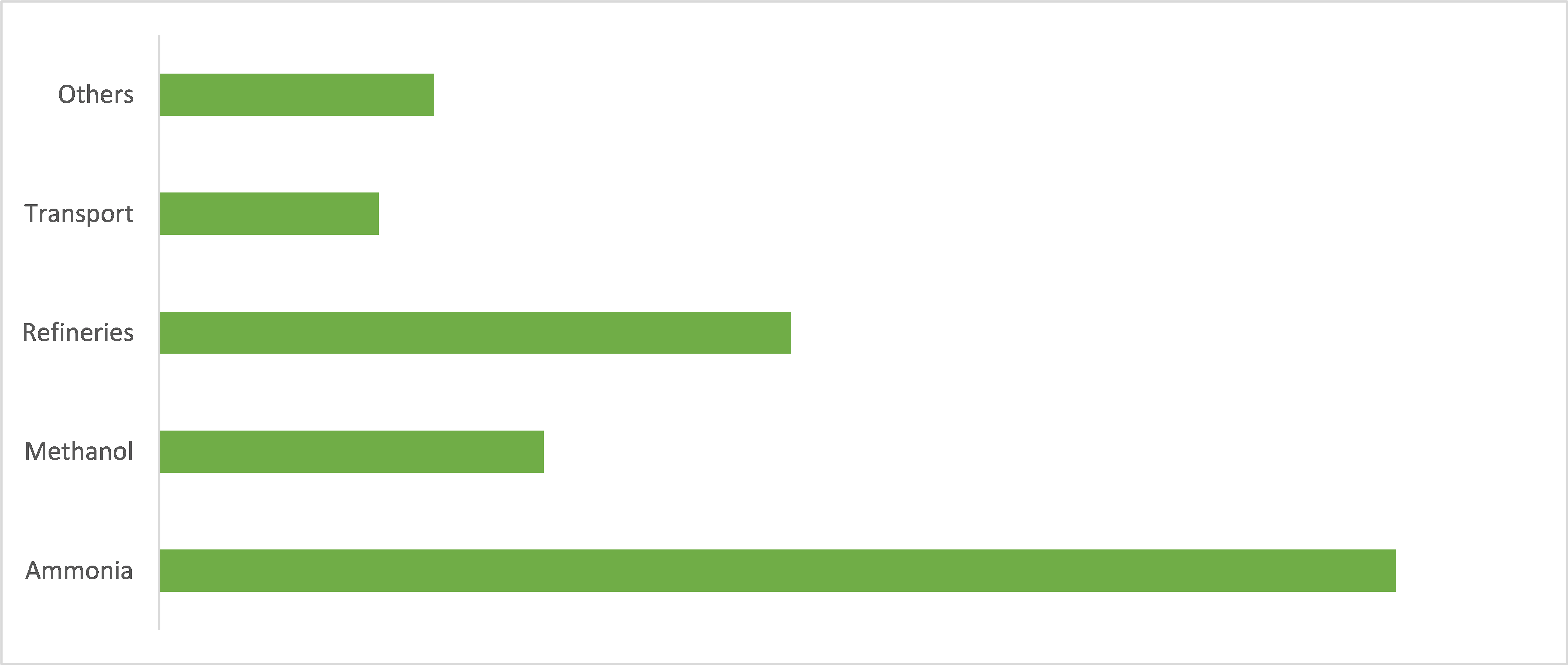

Hydrogen Electrolyzer Market by End-user

By end-user, the market is segmented into ammonia, methanol, refineries, transportation, and others. The ammonia segment captured the largest market share in 2023, while the transportation segment is projected to experience the most rapid growth during the forecast period. Significant expansion is expected in the transportation sector during the forecasted timeframe. Hydrogen's role as a fuel for transportation can expand beyond road transport to include shipping and aviation. The shipping and aviation industries currently rely on heavy fuel oil and jet fuel, respectively. Additionally, there are limited alternatives available to decarbonize these sectors, which are not as readily accessible and are more costly than traditional fuels. Therefore, hydrogen or hydrogen-based compounds have the potential to significantly reduce carbon emissions in shipping and aviation.

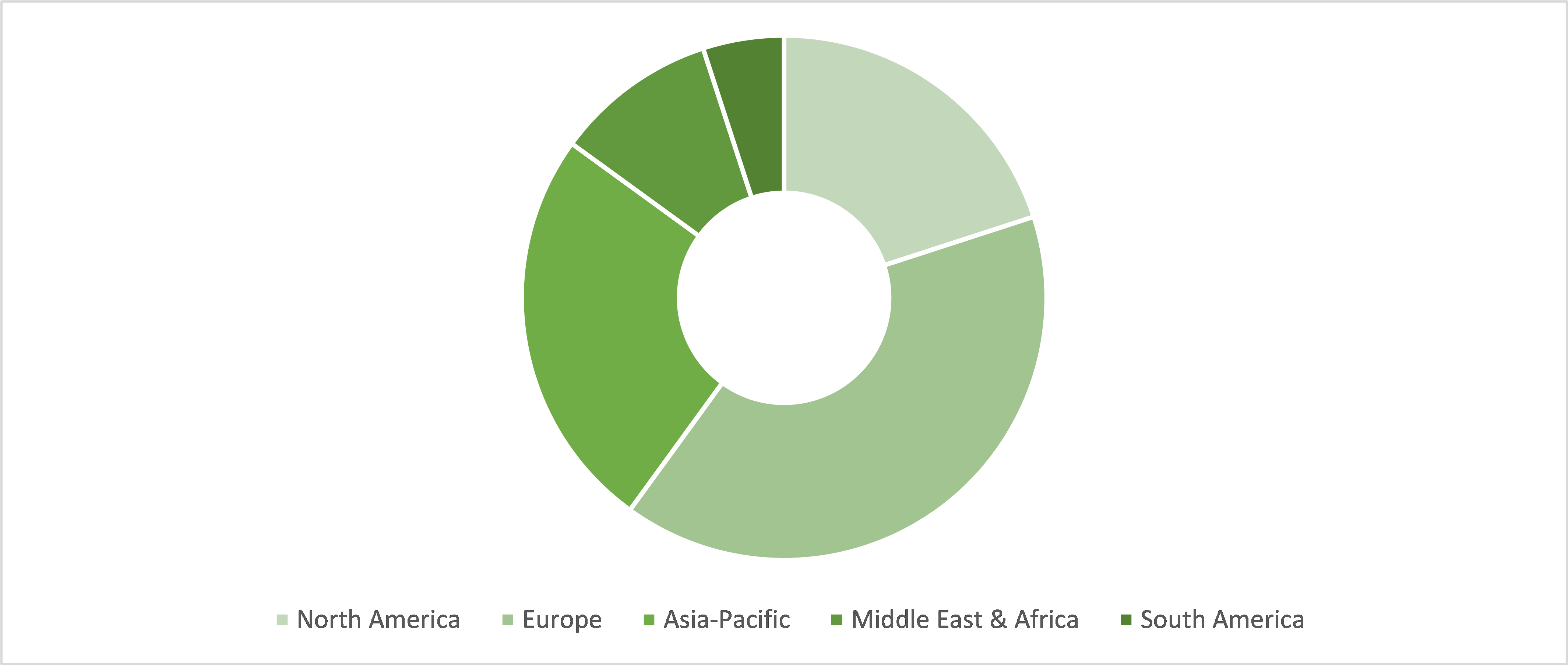

Hydrogen Electrolyzer Market by Region

Regionally, the market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America. Europe dominated the hydrogen electrolyzer market share in 2023. The presence of numerous hydrogen manufacturers throughout the region further supports the growth of the European hydrogen electrolyzer market. Among the European manufacturers of hydrogen electrolyzers are Nel ASA, Siemens AG, McPhy Energy S.A., ITM Power PLC, Gaztransport & Technigaz, Green Hydrogen Systems, ThyssenKrupp nucera, John Cockerill, H2Greem S.L., Sunfire GmbH, and Air Liquide, among others. The demand for hydrogen electrolyzers is expected to increase rapidly in the region during the forecast period due to heightened demand from automotive and industrial sectors.

COVID-19 Impact

Before COVID-19, the hydrogen electrolyzer market was experiencing steady growth due to increasing demand for clean energy solutions and government initiatives supporting renewable energy technologies. Investments were rising, driven by the need to reduce carbon emissions and transition towards sustainable energy sources.

During COVID-19, the market faced challenges as global economic slowdowns and disruptions in supply chains led to project delays and cancellations. Uncertainty and financial constraints hindered investment decisions, impacting the growth trajectory of the market. However, some regions continued to invest in hydrogen infrastructure, recognizing its potential in long-term decarbonization efforts.

Post-COVID-19, the hydrogen electrolyzer market is expected to rebound as governments prioritize economic recovery through green initiatives. Stimulus packages and policy support for renewable hydrogen projects are likely to accelerate market growth. Increased focus on decarbonization and the shift towards renewable energy sources will drive demand for hydrogen electrolyzers, leading to expansion and innovation in the industry. Additionally, growing investments in sectors such as transportation, industrial processes, and energy storage will further boost market opportunities, positioning hydrogen electrolyzers as a key technology in the global transition towards a low-carbon future.

Major Players in the Hydrogen Electrolyzer Market

The market players in the global hydrogen electrolyzer market are Siemens AG, Nel Hydrogen, McPhy Energy, ITM Power Plc, Gaztransport & Technigaz, GreenHydrogen Systems, Next Hydrogen, Hydrogenics (Cummins), Asahi Kasei, thyssenkrupp nucera, Plug Power, Toshiba Corporation, Sunfire GmbH, John Cockerill, and Bloom Energy.

Key Developments

- In March 2024, L&T announced the inauguration of its first domestically produced electrolyzer at the Green Hydrogen Plant in Hazira, Gujarat. Boasting a 1MW capacity (expandable to 2MW), it has the capability to generate 200 normal cubic meters of hydrogen per hour. This achievement underscores L&T's dedication to sustainable energy solutions. Manufactured by L&T Electrolysers Ltd, a newly established subsidiary specializing in pressurized alkaline electrolyzers, the electrolyzer is outfitted with two stacks and an Electrolyzer Processing Unit (EPU) ML-400.

- In March 2024, Power to Hydrogen collaborated with leading international utility companies such as American Electric Power, EDP, E. ON, and Electricity Supply Board to introduce the inaugural Anion Exchange Membrane-based electrolysis stack. This milestone marks a significant advancement in the quest for cost-effective green hydrogen production, offering a promising alternative to fossil fuels in both energy storage and industrial applications.

- In February 2024, De Nora Deutschland GmbH (De Nora), secured orders for electrolyzer cells from ThyssenKrupp nucera. These orders represent a pivotal moment in Europe's transition to green hydrogen. The electrolyzer cells will be supplied for an innovative water electrolysis plant in Sweden.

Market Players

- Siemens AG

- Nel Hydrogen

- McPhy Energy

- ITM Power Plc

- Gaztransport & Technigaz

- GreenHydrogen Systems

- Next Hydrogen

- Hydrogenics (Cummins)

- Asahi Kasei

- thyssenkrupp nucera

- Plug Power

- Toshiba Corporation

- Sunfire GmbH

- John Cockerill

- Bloom Energy

Market Segmentation

By Type Segment

- Proton Exchange Membrane (PEM) Electrolyzer

- Alkaline Electrolyzer

- Solid Oxide Electrolyzer

- Anion Exchange Membrane (AEM) Electrolyzer

By Capacity Segment

- Below 500 kW

- 500 kW - 2 MW

- Above 2 MW

By End User Segment

- Ammonia

- Methanol

- Refineries

- Transport

- Others

By Region Segment

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Netherlands

- Switzerland

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Indonesia

- Rest of Asia-Pacific (APAC)

- Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- Rest of Middle East & Africa (MEA)

- South America (SAM)

- Brazil

- Argentina

- Colombia

- Rest of South America (SAM)

Interested in this report?

Hydrogen Electrolyzer Market Size and Forecast to 2030: By Type (Proton Exchange Membrane (PEM) Electrolyzer, Alkaline Electrolyzer, Solid Oxide Electrolyzer, Anion Exchange Membrane (AEM) Electrolyzer), Capacity (Below 500 kW, 500 kW – 2 MW, Above 2 MW), End-user (Ammonia, Methanol, Refineries, Transport, Others), and Region

TOC