The Global Zero Trust Security Marketwas valued at USD29.81 Billion in 2023 and is estimated to reach USD 121.5 Billion by 2033, growing at a CAGR of17% from 2023 to 2033.

Scope of the market:

Zero Trust Security is a perimeter-based approach. The Zero Trust security model is based on the concept of removing implicit trust and implementing strong IAM controls to ensure that only authorized individuals, applications, and devices have access to organizations' data and systems.Zero Trust Security ensures access to network resources by verifying each device and user attempting, to connect protecting them for data integration and confidentially both in transit and at rest. Moreover, cloud security safeguards cloud environments and data stored in the cloud. As per the deployment, the on-premises are deployed within the organization's data center’s and infrastructure, whereas, the cloud-based, solutions are hosted on cloud services provider platforms, providing flexibility and scalability. The opportunities that grow the demand for zero-trust security are machine learning, advancement in Artificial intelligence, and collaboration between security vendors.

According to the IAM report, vendor Okta has been increasing in the organization adopting a zero-trust approach. Okta also found 61% of organizations have already implemented zero-trust initiatives.

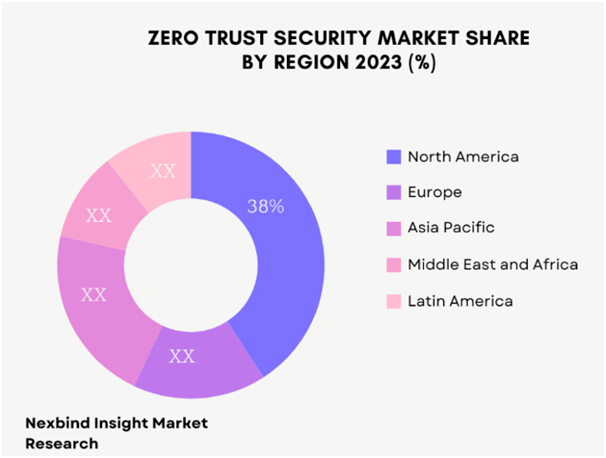

According to CSO, in 2023: Those planning to implement a zero-trust security initiative in the next 18 months make up 35% of respondents and only 4% were neither planning nor had one in place. The North American region is leading in terms of initiatives already in place, but EMEA and APJ organizations are quickly gaining ground, and nearly all the holdouts in both regions plan to adopt a zero-trust initiative within the next 6 to 12 or 13 to 18 months.

Despite macroeconomic pressures forcing cost cutting, 80% of the respondents reported that their budgets for zero-trust security initiatives had increased over the previous year— 60% reported budget increases of between 1% and 24%, and another 20% increased by 25% or more.

Identity has become a big part of zero trust strategies with 51% of all respondents saying it is extremely important, a considerable increase from 2022’s 27%. Another 40% said it is somewhat important

Economic Impact of COVID-19:

The COVID-19 pandemic caused many organizations to adopt remote work models. This sudden shift attacked the surface as employees got access to use company’s network from any devices and location, which hampered the security measures to some extent. Consequently, there was a sudden demand for Zero Trust Security solutions to secure and keep safe remote access, and has to be ensured that only authorized and authenticated users should get access to use the sensitive information. Remote work led to cyber-attack, viruses, ransomware, and phishing, this was the question mark on traditional perimeter-based security models and raised an opportunity to adopt and implement Zero Trust Security.

The analysis of the COVID-19 recovery trajectory provides an overview of the main strategies that industries are implementing to respond to and recover from the economic crisis. It also focuses on the post-pandemic and pre-pandemic era of the Global Zero Trust Security Market through PEST analysis, SWOT, Quantitative and Qualitative analysis, Attractive analysis, and DROs.

Key Players:

- Palo Alto Networks Inc

- Cisco Systems Inc

- IBM Corporation

- Okta Inc

- Fortinet Inc

- CyberArk Software Ltd

- Microsoft Corporation

- Check Point Software Technologies Ltd

- Symantec Corporation

- Proofpoint Inc

- Google LLC

- VMware Inc

- Akamai Technologies

- Centrify Corporation

- Broadcom Inc

- Pulse Secure LLC

- Sophos Group Plc

- Other

The above key players in the Global Zero Trust Security Market can be changed according to the client’s requirements. Forming strategic partnerships with players in industries like agriculture, mining, and oil and gas could give deeper penetration.

Moreover, the key players aim towards expansion, joint ventures, collaboration, mergers, and acquisitions to advance capabilities in the Zero Trust SecurityMarket.Strategic acquisitions and growth-driven mergers are highly desirable in the current landscape, with the Technology and Health sectors demonstrating leadership.A thriving M&A market is anticipated to be sparked by the opportunity provided by solid company balance sheets, better financing terms, and industry-specific drivers.

Recent Developments in the GlobalZero Trust SecurityMarket:

In 2023:

Fortinet and the Gartner Hype Cycle for Zero Trust Networking:

October 31st, 2023, Gartner projects by 2026, 10% of large enterprises will have a comprehensive, measurable zero trust program in place, up from less than 1% in 2023.This philosophy of zero trust will align with Fortinet's approach to providing integrated solutions that enable zero trust and increased security across the organization.

Fortinet is committed to helping an organization achieve zero-trust goals, as a sample vendor in 6 zero-trust categories viz. Universal ZTNA, Hybrid mesh firewall platform, Digital experience monitoring, Secure access service edge, ZTNA, and Micro-segmentation.

Accenture Teams with Palo Alto Networks to Bolster Zero Trust Security:

June 27th, 2023, Accenture and Palo Alto Networks have come together to deliver joint secure access services edge (SASE) solutions that enabled organizations to improve their cybersecurity posture and accelerate business transformation initiatives.

Global Zero Trust Security Market Key Benefits:

- The report provides information regarding key drivers, restraints, and opportunities with impact analysis.

- Quantitative and Qualitative analysis of the current market.

- Estimations for the forecast period 2033.

- Historical data and forecast data.

- Recent developments and trends in the market.

- Market share of the market players, company profiles, SWOT analysis, and competitive landscape.

- Covid-19 Impact analysis

Global Zero Trust Security Market Segmentation:

By Deployment:

- Cloud

- On-premise

By Organization Size:

- Large Enterprises

- Small and Medium Enterprise

By Authentication Types:

- Single-Factor Authentication

- Multi-Factor Authentication

By End User:

- BSFI

- Healthcare

- Manufacturing

- IT and Telecom

- Energy and Power

- Retail

- Other

By Solution Type:

- Data Security

- API Security

- Endpoint Security

- Cloud Security

- Network Security

- Other

By Region:

Asia-Pacific

- Japan

- China

- India

- Australia

- New Zealand

- Rest of Asia-Pacific

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- Italy

- Spain

- UK

- Rest of Europe

Rest of the World

Each of the market segments has been analyzed in detail for market trends, recent trends and developments, drivers, restraints, opportunities, and competitive analysis.

Research Scope:

|

Report Scope |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2023 to 2033 |

|

Historical Years |

2019 to 2023 |

|

Market Size 2023 |

29.81BN |

|

Market Revenue 2033 |

121.5BN |

|

Growth Rate 2023- 2033 |

17 % |

|

Report Coverage |

Trends, SWOT Analysis, Competitive Landscape, DROs, Revenue Forecast, PEST Analysis. |

|

Segments Covered |

Deployment, Organization Size, Authentication Type, End User, Solution Type, Region |

|

Companies Mentioned |

Palo Alto Networks Inc, Cisco Systems Inc, IBM Corporation, Okta Inc, Fortinet Inc, CyberArk Software Ltd, Microsoft Corporation, Check Point Software Technologies Ltd, Symantec Corporation, Proofpoint Inc, Google LLC, VMware Inc, Akamai Technologies, Centrify Corporation, Broadcom Inc, Pulse Secure LLC, Sophos Group Plc |

|

Customization |

Yes |

Regional Analysis:

North America is showing its dominance over other regions due to high awareness, strong regulatory frameworks, and significant investments in cybersecurity. Continuing with the presence of key players and a high level of security from cyber-attacks. The strict regulation from US governance drives the adoption of zero trust security in the coming years.

Europe also shows its significance in the zero-trust security market as it follows stringent data protection laws like GDPR which drives the adoption of zero security models. The increase in adoption of zero trust security frameworks to enhance their cybersecurity. Moreover, many companies in the UK have also started offering zero-trust security solutions and services. Europe also has a large market for BSFI and advanced developments for FinTech. BSFI also shares security for firewalls, identity and access management, and data loss prevention. According to Gartner, 10% of large enterprises will have a zero-trust model by 2026.In general, more than 60% of businesses will embrace Zero Trust Security by 2025.

Key questions answered by this report.

- Top market players contributing to the revenue?

- Trending strategies by the players?

- Which region will be the leading one in the forecast period?

- Factors that drive the Global Zero Trust Security Market?

- Which factors will affect the Global Zero Trust Security Market?

- How Covid-19 pandemic impact the growth of the Global Zero Trust Security Market?

- Which Segment accounted for the Global Zero Trust Security Marketshares?

Frequently Asked Questions (FAQ) :

TOC