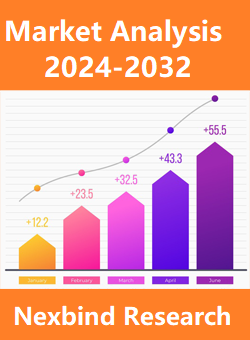

The size of the global digital forensics market reached USD 5.2 billion in 2023 and is projected to exceed USD 13.0 billion by 2030, demonstrating a growth rate of more than 12.3% from 2024 to 2030.

Market Definition:

Digital forensics, also known as computer forensics, is a branch of forensic science that encompasses the investigation and analysis of digital devices, data, and networks to uncover evidence of cybercrimes or digital misconduct. It involves the systematic collection, preservation, examination, and interpretation of electronic evidence, such as files, emails, log files, and metadata, to reconstruct events, identify perpetrators, and support legal proceedings. Digital forensics techniques utilize specialized software tools and methodologies to extract and analyze data from a variety of digital sources, including computers, smartphones, tablets, servers, and cloud storage systems. The ultimate goal of digital forensics is to gather admissible evidence that can be presented in a court of law to support criminal or civil investigations, prosecutions, or litigation related to cybercrimes, data breaches, intellectual property theft, fraud, and other digital offenses. Digital forensic experts, often referred to as digital investigators or forensic analysts, play a critical role in conducting thorough and objective examinations of digital evidence, adhering to legal and ethical standards, and providing expert testimony in legal proceedings to assist in the administration of justice and ensure the integrity of digital investigations.

Digital forensics Market Drivers and Trends:

Increasing Cybercrime Incidents

One of the primary driving factors behind the growth of the digital forensics market is the alarming rise in cybercrime incidents globally. With the increasing digitization of business operations, the proliferation of internet-connected devices, and the growing reliance on digital technologies, cybercriminals have found new avenues to exploit vulnerabilities and perpetrate a wide range of cybercrimes. These cybercrimes include data breaches, ransomware attacks, financial fraud, intellectual property theft, and online harassment, among others. As organizations and individuals become more interconnected and reliant on digital infrastructure, the threat landscape continues to evolve, posing significant challenges to cybersecurity and necessitating robust digital forensic capabilities to investigate and mitigate cyber threats.

Furthermore, the high financial costs and reputational damages associated with cybercrime incidents have prompted organizations across various industries to prioritize investments in digital forensics solutions and services. In the event of a cyber attack or data breach, digital forensics plays a crucial role in identifying the root cause, containing the damage, and recovering lost or compromised data. As a result, organizations are increasingly investing in advanced digital forensics tools, technologies, and expertise to enhance their cyber resilience and incident response capabilities, driving market growth.

Regulatory Compliance Requirements

Another key driving factor of the digital forensics market is the growing emphasis on regulatory compliance and data protection standards. Governments and regulatory authorities worldwide have implemented stringent data protection regulations and compliance requirements to safeguard sensitive information, ensure privacy rights, and hold organizations accountable for data breaches and cyber incidents. Regulations such as the General Data Protection Regulation (GDPR), Health Insurance Portability and Accountability Act (HIPAA), Payment Card Industry Data Security Standard (PCI DSS), and various industry-specific mandates impose strict requirements for data handling, breach notification, and forensic investigation procedures. Consequently, organizations are compelled to invest in digital forensics solutions and services to achieve compliance with regulatory mandates and demonstrate due diligence in safeguarding sensitive data. Additionally, regulatory requirements often mandate the retention and preservation of digital evidence for forensic analysis in the event of legal proceedings or regulatory investigations, further driving the demand for digital forensics capabilities. As organizations strive to navigate complex regulatory landscapes and mitigate regulatory risks, investments in digital forensics technologies and expertise are expected to continue to grow, fueling market expansion.

Digital forensics Market Restraints and Challenges:

Rapidly Evolving Technology

One significant challenge facing the digital forensics market is the rapid evolution of technology and digital devices. As technology continues to advance at a rapid pace, new devices, operating systems, applications, and communication protocols are constantly being introduced, presenting challenges for digital forensic investigators. Keeping pace with these technological advancements requires continuous learning, training, and adaptation of forensic techniques and methodologies. Moreover, the complexity and diversity of digital devices and storage media present challenges for forensic analysis, as each device may have unique features, encryption methods, and proprietary file systems that require specialized tools and expertise to extract and analyze data effectively.

Furthermore, the increasing use of encryption and security measures by individuals and organizations to protect their digital assets poses challenges for digital forensic investigations. Encrypted data presents obstacles for forensic analysts attempting to access and analyze digital evidence, as decryption keys may not be readily available or accessible. Additionally, the proliferation of cloud storage and communication services complicates forensic investigations, as data stored in the cloud may be subject to jurisdictional challenges, legal restrictions, and privacy concerns. Cloud service providers may also employ encryption and other security measures that impede forensic analysis, requiring investigators to navigate complex legal and technical issues to obtain access to relevant data.

Legal and Ethical Considerations

Another significant restraint in the digital forensics market is the complex legal and ethical considerations surrounding the collection, preservation, and analysis of digital evidence. Digital forensic investigations must adhere to legal standards, rules of evidence, and chain of custody protocols to ensure the admissibility and integrity of digital evidence in legal proceedings. However, navigating legal frameworks and regulations governing digital evidence can be challenging, particularly in cases involving cross-border jurisdictional issues, privacy rights, and data protection laws. Investigators must also adhere to ethical guidelines and professional standards when conducting digital forensic examinations, including maintaining objectivity, integrity, and confidentiality throughout the investigation process.

Moreover, the rapid growth of digital data and the increasing complexity of digital forensic investigations pose challenges for forensic analysts in managing and processing large volumes of data effectively. Digital forensic tools and techniques may struggle to keep pace with the exponential growth of digital evidence, leading to delays, inefficiencies, and potential errors in forensic analysis. Additionally, the proliferation of digital devices and storage media, coupled with the diversity of data formats and sources, further complicates the forensic analysis process, requiring forensic examiners to employ sophisticated tools and methodologies to extract, correlate, and interpret digital evidence accurately. Addressing these legal and ethical considerations while effectively managing and analyzing digital evidence remains a significant challenge for the digital forensics market.

Segmental Overview

The digital forensics market is segmented intocomponent, type, end-user, and region.

Digital ForensicsMarket by Component

Bycomponent, the market is segmented into hardware, software, and service. The softwaresegment held the largest market in thedigital forensics market share in 2023.Firstly, advancements in digital forensic software technologies have resulted in the development of sophisticated tools and platforms capable of efficiently analyzing vast amounts of digital data. These software solutions offer comprehensive functionalities for data extraction, analysis, and reporting, enabling forensic investigators to conduct thorough investigations and uncover valuable evidence. Additionally, the increasing complexity of cyber threats and the growing volume of digital evidence have driven demand for specialized software solutions tailored to address evolving forensic challenges, further bolstering the growth of the software segment.

Digital Forensics Market by Type

By type, the market is segmented into mobile forensics, computer forensics, network forensics, and others. The computer forensics segment held the largest market share in 2023. Firstly, with the widespread use of computers in both personal and professional settings, the demand for computer forensics expertise surged. Computer forensics encompasses the investigation and analysis of digital evidence stored on computing devices, making it indispensable in cases of cybercrime, data breaches, and intellectual property theft. Additionally, the increasing sophistication of cyber threats targeting computer systems has underscored the importance of robust forensic capabilities, further driving the demand for computer forensics services and solutions.

Digital ForensicsMarket by End-user

By end-user, the market is segmented into government and law enforcement agencies, BFSI, IT and telecom, and others. The government and law enforcement agencies segment captured the largest market share in 2023.Firstly, government agencies and law enforcement entities face an increasing number of cyber threats and digital crimes, necessitating robust digital forensic capabilities to investigate and prosecute offenders. Additionally, regulatory requirements and legal mandates compel government agencies to invest in digital forensics solutions to ensure compliance with data protection laws and preserve the integrity of digital evidence for legal proceedings. Furthermore, government initiatives aimed at enhancing national cybersecurity and combating cybercrime further drive demand for digital forensic services and technologies within this segment.

Digital Forensics Market by Region

Regionally, the market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America dominated the digital forensics market share in 2023.Firstly, North America boasts a robust cybersecurity ecosystem, driven by extensive investments in research and development, advanced technology infrastructure, and a highly skilled workforce. Additionally, the region is home to numerous leading technology companies, government agencies, and law enforcement organizations that heavily rely on digital forensics capabilities to combat cyber threats and investigate cybercrimes. Furthermore, supportive regulatory frameworks and stringent data protection laws in North America have spurred the adoption of digital forensics solutions across various industries, further solidifying the region's leadership in the market.

COVID-19 Impact

Before the onset of the COVID-19 pandemic, the digital forensics market was experiencing steady growth, driven by increasing cyber threats, rising incidents of cybercrimes, and growing regulatory compliance requirements across various industries. Organizations were increasingly investing in digital forensics solutions and services to enhance their cybersecurity posture, mitigate risks, and ensure compliance with data protection regulations. Additionally, advancements in technology, such as the proliferation of mobile devices, cloud computing, and IoT (Internet of Things) devices, were expanding the scope and complexity of digital forensic investigations, further fueling market demand.

The COVID-19 pandemic had a mixed impact on the digital forensics market. While the heightened cybersecurity risks and increased incidents of cybercrimes during the pandemic drove demand for digital forensics solutions and services, other factors such as budget constraints, resource limitations, and disruptions to business operations posed challenges for market growth. Remote work arrangements and the rapid shift to digital platforms led to an uptick in cyber attacks, phishing scams, and data breaches, highlighting the critical need for digital forensic expertise to investigate and mitigate these threats. However, organizations faced challenges in conducting digital forensic investigations remotely, navigating logistical hurdles, and ensuring the integrity and admissibility of digital evidence in legal proceedings.

As the world transitions into a post-pandemic era, the digital forensics market is expected to witness sustained growth, driven by the continued evolution of cyber threats, increasing regulatory pressures, and the growing importance of digital evidence in legal proceedings. Organizations are likely to prioritize investments in digital forensics capabilities to enhance their resilience against cyber attacks, bolster incident response capabilities, and address compliance requirements. Additionally, advancements in digital forensic technologies, such as automation, artificial intelligence, and machine learning, are expected to streamline investigation processes, improve efficiency, and enable faster response to cyber incidents. Hence, the post-COVID-19 period presents opportunities for the digital forensics market to expand and innovate in response to evolving cybersecurity challenges and digital forensic needs.

Major Players in the Digital Forensics Market

The market players in the global digital forensics market are Cisco Systems Inc., IBM Corporation, Guidance Software Inc. (Opentext), Binary Intelligence LLC, KLDiscovery Inc., AccessData Group LLC, FireEye Inc., Paraben Corporation, LogRhythm Inc., Oxygen Forensics Inc., and MSAB Inc.

Key Developments

- In October 2023, Softcell and Binalyze have announced a strategic partnership to offer incident response and digital forensics services in India. It is anticipated that the collaboration between these two cutting-edge, security-focused companies would result in notable advancements in cybersecurity and digital forensics incident response.

- In September 2023, SentinelOne unveiled Singularity RemoteOps Forensics, a cutting-edge solution designed with incident response and evidence gathering in mind. This cutting-edge technology combines real-time telemetry and forensic data to offer unified insights into security occurrences. As a result, analysts must complete investigation and reaction responsibilities quickly and expertly.

- In September 2023, A partnership has been announced between CBIT Digital Forensics Services (CDFS), experts in forensic data, and Reveal, a leading player in AI-driven eDiscovery, review, and investigation platforms. The goal of this partnership is to offer improved eDiscovery tools and solutions to legal and corporate clients globally. Through this cooperation, CDFS should be able to take use of Reveal's AI-powered platform to expedite the eDiscovery process and provide customers with unrivalled technological capability and experience.

Market Players

- Cisco Systems Inc.

- IBM Corporation

- Guidance Software Inc. (Opentext)

- Binary Intelligence LLC

- KLDiscovery Inc.

- AccessData Group LLC

- FireEye Inc.

- Paraben Corporation

- LogRhythm Inc.

- Oxygen Forensics Inc.

- MSAB Inc.

Market Segmentation

By Component Segment

- Hardware

- Software

- Service

By Type Segment

- Mobile Forensics

- Computer Forensics

- Network Forensics

- Others

By End-user Segment

- Government and Law Enforcement Agencies

- BFSI

- IT and Telecom

- Others

By Region Segment

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Netherlands

- Switzerland

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Indonesia

- Rest of Asia-Pacific (APAC)

- Middle East&Africa (MEA)

- Saudi Arabia

- UAE

- Rest of Middle East & Africa (MEA)

- South America (SAM)

- Brazil

- Argentina

- Colombia

- Rest of South America (SAM)

Frequently Asked Questions (FAQ) :

TOC