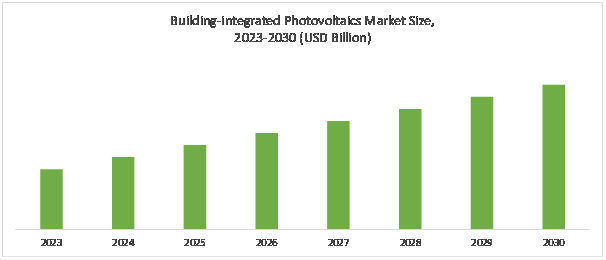

The size of the global building-integrated photovoltaics market reached USD 23.9 billion in 2023 and is projected to exceed USD 88.6 billion by 2030, demonstrating a growth rate of more than 20.6% from 2024 to 2030.

Market Definition:

Building-integrated photovoltaics (BIPV) refer to solar panels or photovoltaic materials that are seamlessly integrated into building structures, serving dual purposes of generating electricity and providing architectural functionality. Unlike traditional solar panels mounted on top of existing structures, BIPV systems are designed to blend with the building's architecture, enhancing aesthetics while harnessing solar energy. These systems can take various forms, including solar roof tiles, solar windows, solar facades, and solar shading devices, allowing for flexibility in design and application.

One key advantage of BIPV is its ability to transform buildings into self-sustaining energy generators, reducing reliance on grid electricity and lowering carbon emissions. By harnessing solar energy directly on-site, BIPV systems can contribute to the sustainability and resilience of buildings, especially in urban environments where space is limited. Additionally, BIPV can help offset energy costs for building owners and occupants, providing long-term financial benefits while promoting renewable energy adoption.

Building-integrated photovoltaicsMarket Drivers and Trends:

Growing Demand for Sustainable Buildings

One driving factor propelling the building-integrated photovoltaics (BIPV) market is the increasing demand for sustainable buildings. As awareness of environmental issues and the importance of reducing carbon emissions grows, there is a rising emphasis on constructing energy-efficient and environmentally friendly buildings. BIPV systems offer an attractive solution by seamlessly integrating solar energy generation into building structures, thereby reducing reliance on fossil fuels and decreasing greenhouse gas emissions. Building owners, developers, and architects are increasingly incorporating BIPV technology into their projects to achieve sustainability goals, enhance energy performance, and demonstrate corporate social responsibility.

Government Incentives and Supportive Policies

Another key driving factor for the BIPV market is the availability of government incentives and supportive policies. Many governments around the world are implementing various incentives, subsidies, and regulatory frameworks to promote the adoption of renewable energy technologies, including BIPV. These measures may include tax credits, rebates, feed-in tariffs, net metering programs, and building codes mandating renewable energy integration. Such incentives not only help offset the higher upfront costs of BIPV systems but also create a favorable business environment for manufacturers, installers, and end-users. Additionally, supportive policies and regulations, such as renewable energy targets and carbon reduction goals, provide market certainty and stimulate investment in BIPV infrastructure. Therefore, government incentives and policies play a crucial role in driving the widespread adoption of BIPV technology and accelerating its market growth.

Building-integrated photovoltaicsMarket Restraints and Challenges:

High Initial Costs

One significant restraint factor affecting the building-integrated photovoltaics market is the high initial costs associated with installation and integration. Compared to traditional building materials, BIPV systems often come with a premium price tag due to the incorporation of solar panels or photovoltaic materials into the building structure. Additionally, the need for specialized installation techniques and architectural design considerations further adds to the upfront expenses. For many building developers and owners, the higher initial costs of BIPV systems can act as a barrier to adoption, especially in projects with tight budgets or limited access to financing.

Technical Complexity and Integration Challenges

Another restraint factor impacting the building-integrated photovoltaics market is the technical complexity and integration challenges involved in implementing these systems. Unlike standalone solar panel installations, BIPV systems require seamless integration into the building's architecture, which can present technical challenges during design, construction, and installation phases. Integrating solar panels or photovoltaic materials into various building components such as roofs, facades, and windows requires careful coordination among architects, engineers, and construction professionals. Moreover, ensuring compatibility with existing building systems and meeting regulatory requirements adds to the complexity of BIPV integration. As a result, the technical challenges and integration complexities associated with BIPV systems can slow down adoption and limit market growth, particularly in regions with stringent building codes and regulations.

Segmental Overview

The global building-integrated photovoltaics market is segmented intotechnology, application, end-use, and region.

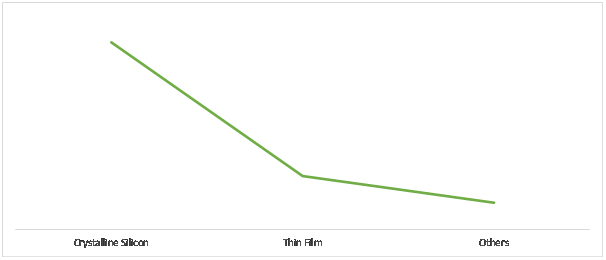

Building-integrated photovoltaicsMarket by Technology

Bytechnology, the market is classified into crystalline silicon, thin film, and others. The crystalline siliconsegment held the largest market in thebuilding-integrated photovoltaics market share in 2023.Crystalline silicon-based BIPV systems are widely favored due to their high efficiency, reliability, and mature manufacturing processes. These systems utilize silicon-based solar cells that are highly efficient in converting sunlight into electricity, making them suitable for a wide range of building-integrated applications. The dominance of crystalline silicon technology underscores its established presence and widespread acceptance in the building-integrated photovoltaics market.

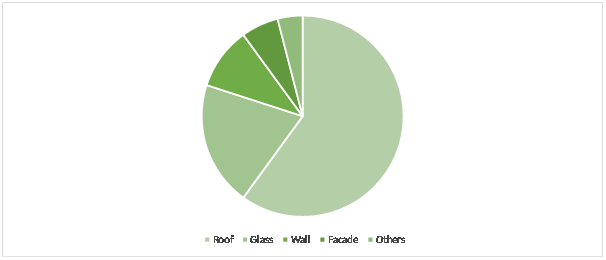

Building-integrated photovoltaicsMarket by Application

By application, the market is classified into roof, glass, wall, facade, and others. The roof segment held the largest market share in 2023.This segment's prominence can be attributed to several factors, including the widespread availability of rooftop space for solar installations, the suitability of roofs for solar panel integration, and the increasing adoption of BIPV systems in residential, commercial, and industrial buildings. Additionally, roof-mounted BIPV solutions offer advantages such as enhanced energy efficiency, reduced electricity costs, and improved aesthetics without occupying additional land area, making them a popular choice among building owners and developers.

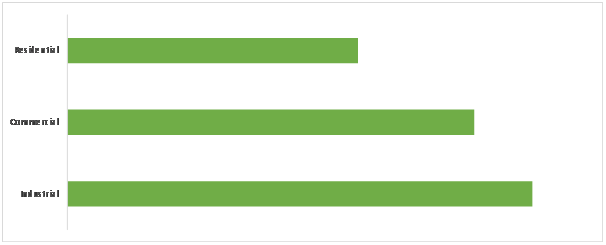

Building-integrated photovoltaicsMarket by End-use

By end-use, the market is segmented into industrial, commercial, and residential. The industrial segment captured the largest market share in 2023.This segment includes a wide range of industrial facilities, such as manufacturing plants, warehouses, and distribution centers, which often have expansive rooftops and ample space for solar installations. Industrial facilities have a high energy demand, making them ideal candidates for BIPV systems to offset electricity costs and reduce reliance on grid power. Additionally, the industrial sector's focus on sustainability and corporate social responsibility further drives adoption of BIPV technology to meet environmental goals.

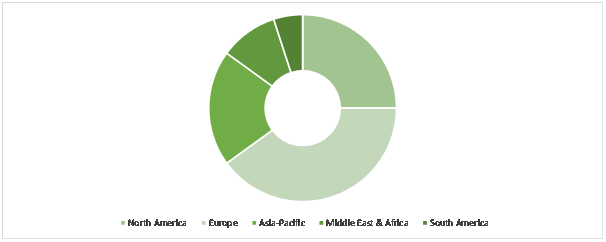

Building-integrated photovoltaicsMarket by Region

Regionally, the building-integrated photovoltaics market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America. Europe dominated the building-integrated photovoltaics market share in 2023.Several factors contributed to Europe's leadership position in BIPV adoption and deployment. Firstly, Europe has been at the forefront of renewable energy initiatives and sustainability efforts, with strong support from governments and regulatory bodies. Additionally, favorable policies, such as feed-in tariffs, renewable energy targets, and building energy performance standards, have incentivized the integration of BIPV systems into new construction and building renovation projects across the region. Furthermore, a mature solar energy ecosystem, robust supply chain, and technological advancements have fostered innovation and market growth in Europe's BIPV sector. Overall, Europe's commitment to renewable energy transition and conducive regulatory environment have propelled its dominance in the building-integrated photovoltaics market.

COVID-19 Impact

Prior to the COVID-19 pandemic, the building-integrated photovoltaics market was experiencing steady growth, driven by increasing awareness of sustainability, rising energy costs, and supportive government policies promoting renewable energy adoption. BIPV systems were being integrated into new construction projects and building renovations, with demand particularly strong in regions with ambitious renewable energy targets and incentives. The market was characterized by technological advancements, expanding product portfolios, and growing investment in research and development.

The COVID-19 pandemic had a mixed impact on the building-integrated photovoltaics market. While some construction projects were delayed or put on hold due to lockdowns, supply chain disruptions, and economic uncertainties, others continued as essential services or with modified operations. The pandemic also led to fluctuations in demand for BIPV systems, with some sectors experiencing decreased investment in renewable energy projects while others maintained or even increased their focus on sustainability amid the crisis. Additionally, remote working arrangements and travel restrictions posed challenges for project planning, implementation, and collaboration within the BIPV industry.

As the world emerges from the COVID-19 pandemic, the building-integrated photovoltaics market is expected to rebound, driven by pent-up demand, economic recovery efforts, and ongoing commitments to sustainability and renewable energy transition. Governments may prioritize green stimulus packages and infrastructure investments to stimulate economic growth while addressing climate change goals. Moreover, the pandemic has heightened awareness of the importance of resilient and sustainable buildings, driving demand for BIPV systems as part of green building initiatives. Technological advancements, cost reductions, and supportive policies are expected to further accelerate the adoption of BIPV solutions in the post-COVID-19 era, positioning the market for long-term growth and innovation.

Major Players in the Building-integrated PhotovoltaicsMarket

The market players in the global building-integrated photovoltaics market are AGC Inc., Ertex Solar, Hanergy Mobile Energy Holding Group Limited, Heliatek GmbH, NanoPV Solar Inc., Onyx Solar Group LLC, Polysolar Ltd, Tesla, The Solaria Corporation, and ViaSolis.

Key Developments

- In January 2024, A cross-sectional instrument for BIPV assessment is released by IEA-PVPS. The building-integrated photovoltaics (BIPV) industry is changing, which makes the creation of an extensive multidisciplinary evaluation approach necessary. A cross-sectional assessment tool was created by IEA-PVPS Task 15 specifically for use by developers, architects, and other project participants in BIPV initiatives. This approach provides a comprehensive tool for analysing and optimising BIPV systems by addressing economic, energy-relevant, environmental, and visual performance through a methodical procedure.

- In November 2022, TÜV Rheinland expands sustainability services, introducing a world-exclusive certification for building-integrated photovoltaic (BIPV) modules meeting stringent safety and quality standards. This certification streamlines building authority approvals and adds value for solar system stakeholders. The new test standard (2 PfG 2796/02.22) fills a crucial gap in BIPV system certification, ensuring adherence to safety and quality requirements.

- In March 2021, Solarvolt building-integrated photovoltaic (BIPV) glass modules, which combine the performance and aesthetics of Vitro Glass products with CO2-free power generation and weather protection for commercial buildings, have been introduced by Vitro Architectural Glass (previously PPG Glass). Solarvolt BIPV modules can be used to improve a variety of exterior building features, such as balconies and balustrades, skylights and overhead glazing, facades, and opacified spandrel glass. They can also be used to replace traditional cladding materials, lower air conditioning costs, and passively generate solar power.

Market Players

- AGC Inc.

- Ertex Solar

- Hanergy Mobile Energy Holding Group Limited

- Heliatek GmbH

- NanoPV Solar Inc.

- Onyx Solar Group LLC

- Polysolar Ltd

- Tesla

- The Solaria Corporation

- ViaSolis

Market Segmentation

By Technology Segment

- Crystalline Silicon

- Thin Film

- Others

By Application Segment

- Roof

- Glass

- Wall

- Facade

- Others

By End-use Segment

- Industrial

- Commercial

- Residential

By Region Segment

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Netherlands

- Switzerland

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Indonesia

- Rest of Asia-Pacific (APAC)

- Middle East&Africa (MEA)

- Saudi Arabia

- UAE

- Rest of Middle East & Africa (MEA)

- South America (SAM)

- Brazil

- Argentina

- Colombia

- Rest of South America (SAM)

Frequently Asked Questions (FAQ) :

Interested in this report?

The size of the global building-integrated photovoltaics market reached USD 23.9 billion in 2023 and is projected to exceed USD 88.6 billion by 2030, demonstrating a growth rate of more than 20.6% from 2024 to 2030.

TOC