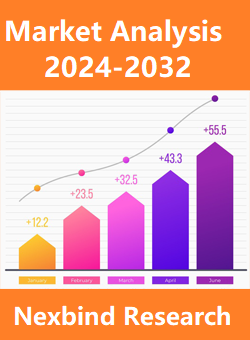

The size of the global dealer management system market reached USD 8.5 billion in 2023 and is projected to exceed USD 15.6 billion by 2030, demonstrating a growth rate of more than 9.1% from 2024 to 2030.

Market Definition:

A dealer management system (DMS) is a comprehensive software solution designed to streamline and optimize various aspects of automotive dealership operations. It serves as a centralized platform that enables dealerships to efficiently manage their day-to-day activities, including inventory management, sales and customer relationship management (CRM), service scheduling, finance and accounting, reporting, and analytics. By integrating key functions into a single system, a DMS facilitates seamless communication and collaboration across different departments within the dealership, enhancing overall operational efficiency and productivity.

Additionally, modern DMS solutions often incorporate advanced features such as integration with third-party applications, mobile access, data analytics capabilities, and automation tools to further improve dealership performance and customer satisfaction. Ultimately, a dealer management system plays a crucial role in helping automotive dealerships effectively manage their resources, streamline workflows, and maximize profitability in a highly competitive industry.

Dealer management system Market Drivers and Trends:

Automotive Industry has Witnessed Numerous Technological Innovations

The automotive industry's continual embrace of technological advancements serves as a significant driving force behind the growth of the dealer management system (DMS) market. As automotive manufacturers and dealerships integrate innovative technologies into their operations, the need for efficient management solutions becomes increasingly pronounced. These technological innovations encompass a wide range of areas within the automotive industry, including vehicle manufacturing processes, customer engagement platforms, digital marketing strategies, and vehicle connectivity features.

One of the primary factors fueling the demand for DMS solutions is the growing complexity of automotive dealership operations due to technological advancements. As vehicles become more sophisticated and connected, dealerships require robust management systems to effectively manage inventory, sales, customer relationships, service operations, and financial transactions. DMS solutions offer comprehensive functionality to streamline these operations, providing dealerships with the tools they need to navigate the intricacies of the modern automotive landscape.

Moreover, the rise of electric vehicles (EVs), autonomous driving technologies, and digital retailing models is reshaping the automotive industry and driving the adoption of DMS solutions. Electric vehicle manufacturers and dealerships require specialized management systems to handle the unique requirements of EV sales, servicing, and charging infrastructure management. Similarly, the emergence of autonomous vehicles necessitates advanced DMS capabilities to support vehicle fleet management, remote diagnostics, and predictive maintenance. Additionally, the shift towards digital retailing models, driven by changing consumer preferences and the COVID-19 pandemic, underscores the importance of DMS solutions in enabling seamless online transactions and omnichannel customer experiences.

Furthermore, the automotive industry's emphasis on data-driven decision-making and business intelligence is driving the demand for DMS solutions with advanced analytics and reporting capabilities. Dealerships are increasingly leveraging data analytics to gain insights into customer preferences, market trends, inventory performance, and operational efficiency. DMS solutions that offer robust analytics tools empower dealerships to optimize their strategies, improve decision-making processes, and drive business growth in an increasingly competitive market landscape. Overall, the automotive industry's ongoing technological innovations serve as a catalyst for the continued expansion and evolution of the dealer management system market, driving innovation and adoption across the automotive dealership ecosystem.

Growing Demand for Integrated Solutions

In the dynamic landscape of automotive retail, the burgeoning demand for integrated solutions emerges as a significant driving force propelling the dealer management system (DMS) market forward. As automotive dealerships strive to enhance operational efficiency, optimize customer engagement, and maximize profitability, the need for comprehensive software solutions that seamlessly integrate various dealership functions becomes increasingly imperative. Integrated DMS platforms offer dealerships a unified approach to managing inventory, sales, finance, service, and customer relationships, enabling streamlined workflows and improved decision-making processes.

Moreover, the evolution of consumer expectations in the automotive retail sector underscores the importance of integrated solutions in meeting the demands of today's tech-savvy and digitally empowered customers. Modern consumers expect a seamless and personalized experience throughout their journey with the dealership, from browsing inventory online to completing transactions and receiving post-sale support. Integrated DMS solutions enable dealerships to deliver a cohesive and frictionless customer experience by consolidating data from multiple touchpoints and providing real-time insights into customer preferences and behaviors.

Furthermore, the increasing complexity of automotive retail operations, driven by factors such as globalization, regulatory compliance, and the growing diversity of vehicle models and technologies, underscores the need for integrated DMS solutions that can adapt to evolving industry trends and challenges. Integrated platforms offer dealerships the flexibility and scalability to efficiently manage diverse dealership functions and respond to changing market dynamics. Additionally, integrated DMS solutions empower dealerships to harness the power of data analytics and business intelligence to gain actionable insights into market trends, customer behavior, and operational performance, enabling them to make informed decisions and drive business growth.

Thus, the growing demand for integrated solutions that streamline dealership operations, enhance customer engagement, and enable data-driven decision-making serves as a key driving factor behind the expansion of the dealer management system market. Integrated DMS platforms not only offer automotive dealerships the tools they need to succeed in today's competitive market but also position them for future growth and innovation in the rapidly evolving automotive retail landscape.

Dealer management system Market Restraints and Challenges:

Data Security Concerns

The dealer management system (DMS) market faces significant challenges, one of which revolves around data security concerns. With the extensive amount of sensitive information stored within DMS platforms, including customer data, financial records, and inventory details, ensuring robust data security measures becomes paramount. However, the increasing sophistication of cyber threats poses a constant challenge for DMS providers and users alike. Breaches in data security not only jeopardize the confidentiality and integrity of dealership operations but also undermine customer trust and compliance with data protection regulations.

Moreover, as DMS solutions become increasingly integrated with other systems and connected to external networks, the attack surface for potential cyber threats expands, heightening the risk of security breaches. Unauthorized access, data breaches, and malware attacks are among the top concerns faced by dealerships utilizing DMS platforms. Addressing these challenges requires continuous investment in cybersecurity infrastructure, employee training, and adherence to industry best practices to safeguard sensitive data and mitigate security risks effectively.

Integration Complexity

Another significant restraint in the Dealer Management System market is integration complexity. Dealerships often operate with a multitude of software solutions for various functions, including inventory management, customer relationship management, accounting, and more. Integrating these disparate systems with a DMS platform can pose significant challenges due to differences in data formats, protocols, and compatibility issues. The complexity of integration can result in prolonged deployment times, increased implementation costs, and disruptions to daily operations.

Furthermore, as dealerships seek to leverage advanced functionalities and emerging technologies within their DMS platforms, such as artificial intelligence, predictive analytics, and mobility solutions, the complexity of integration further intensifies. Ensuring seamless interoperability between different systems and maintaining data consistency across platforms become critical factors for successful DMS implementation. Overcoming integration challenges requires collaboration between DMS vendors, third-party solution providers, and dealership IT teams to develop standardized interfaces, data mapping strategies, and integration frameworks that facilitate smooth data exchange and workflow automation.

Segmental Overview

The dealer management system market is classifiedintocomponent, deployment type, application,end user, and region.

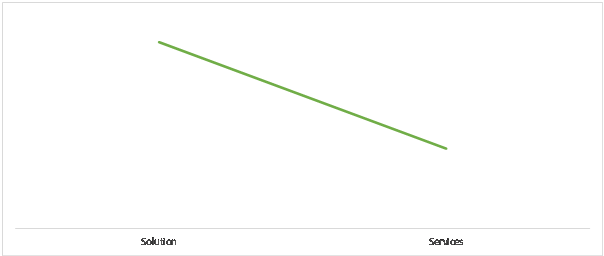

Dealer management system Market by Component

Based on component, the dealer management system market is bifurcated into solution and services. The forecast period is expected to witness the dominance of the solution segment in the market. Within the dealership management system market, the solution segment encompasses a wide array of software offerings tailored to streamline automotive dealerships' operations. Dealer tracking, inventory management, sales, financing, and customer relationship management tasks can all be efficiently managed through dealership management system software, facilitating seamless coordination among these activities. This robust software application empowers car dealerships to access comprehensive solutions via a fully integrated platform. Such solutions play a crucial role in assisting businesses to sustain long-term profitability.

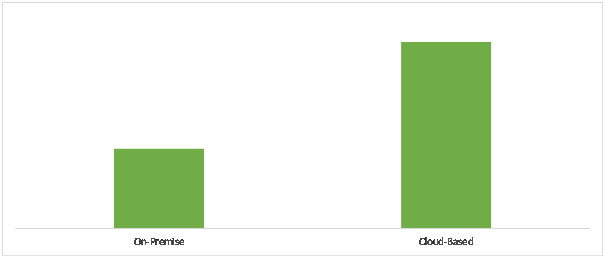

Dealer management system Market by Deployment Type

On the basis of deployment type, the dealer management system market is bifurcated into on-premise and cloud-based. The market is expected to be dominated by the cloud-based segment throughout the forecast period. A dealer management system (DMS) operating in the cloud utilizes servers accessed via the Internet, providing flexibility and facilitating easy updates. Cloud-based software is increasingly popular in 2023 due to its cost-effectiveness, with the robust network infrastructure in the U.S. further aiding its adoption. Enterprises are strategically investing in advanced software solutions to swiftly transition to modern platforms with enhanced features. The recent increase in the usage of cloud-based software can be attributed to the numerous advantages offered by cloud technology, including seamless support and maintenance services, rapid setup and deployment, easy upgrade options, and broad accessibility.

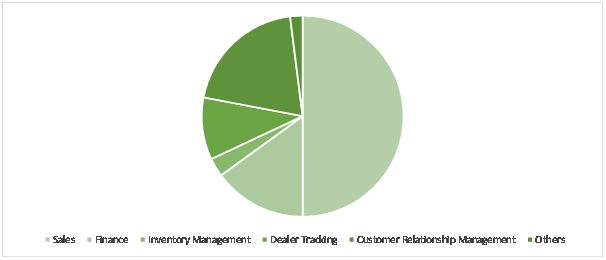

Dealer management system Market by Application

Based on application, the dealer management system market is segmented into sales, inventory management, finance, dealer tracking, customer relationship management, and others. During the forecast period, it is expected that the sales segment will take the lead in the market. Within a dealer management system (DMS), the sales application holds significant importance, serving to facilitate and enhance sales processes within automotive dealerships. Typically, this application incorporates functionalities like lead management, inventory tracking, and customer relationship management (CRM). It empowers dealers to effectively manage sales inquiries, oversee vehicle inventory, monitor customer interactions, and optimize the overall sales workflow.

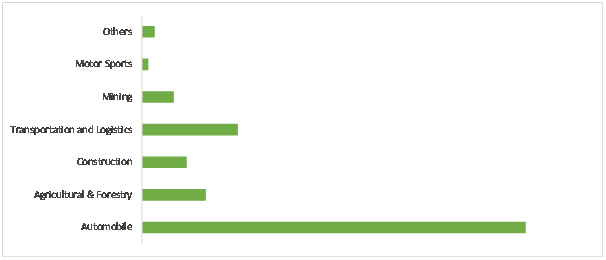

Dealer management system Market by End User

Based on end user, the dealer management system market is divided into automobile, agricultural & forestry, construction, transportation and logistics, mining, motor sports, and others. The market is expected to be led by the automobile sector throughout the forecast period. Within the automobile industry, a dealer management system holds significant importance in optimizing various operational functions of automotive dealerships, particularly for light-duty vehicles. The incorporation of a meticulously crafted DMS within the automobile sector leads to enhanced effectiveness, increased customer contentment, and greater profitability for dealerships. Acting as an all-encompassing solution, it manages the intricacies of automotive retail operations within an industry undergoing rapid evolution.

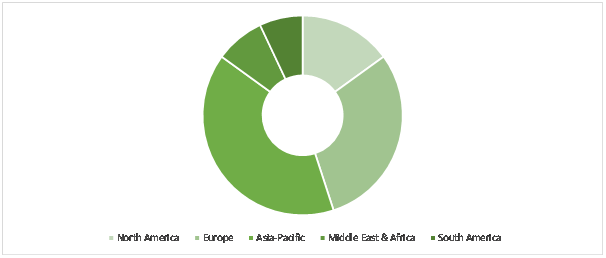

Dealer management system Market by Region

Regionally, the market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America. During the forecast period, it is anticipated that the Asia Pacific market will emerge as the dominant force. This surge can be credited to the thriving automotive industry, rapid urbanization, and escalating consumer demand for cutting-edge technological solutions. As dealerships within the region increasingly recognize the significance of efficient management systems, the adoption of dealer management systems (DMS) is on an upward trajectory. Additionally, the digital transformation endeavors in nations such as China and India are hastening the integration of DMS to streamline operations, enhance customer experiences, and optimize overall business efficacy. The evolving automotive landscape in the Asia Pacific region presents substantial opportunities for DMS providers, thereby bolstering the sustained growth of the market in this geographic area.

COVID-19 Impact

Before the COVID-19 pandemic, the dealer management system (DMS) market was experiencing steady growth, driven by factors such as increasing digitization in the automotive industry, rising demand for integrated dealership management solutions, and the adoption of advanced technologies like artificial intelligence and data analytics. Dealerships were investing in DMS platforms to streamline operations, improve customer service, and enhance overall efficiency. The market was characterized by a competitive landscape with vendors offering a range of features tailored to meet the specific needs of automotive dealers.

The COVID-19 pandemic had a significant impact on the dealer management system market. With lockdowns and social distancing measures in place, automotive dealerships faced challenges such as temporary closures, reduced foot traffic, and disruptions to supply chains. This led to a slowdown in new DMS implementations and a shift in priorities for existing users, with a greater focus on cost optimization, remote operations, and online sales channels. Dealerships increasingly relied on DMS platforms to manage inventory, engage with customers digitally, and streamline back-office processes to adapt to the changing business landscape.

As the automotive industry emerges from the COVID-19 pandemic, the dealer management system market is expected to rebound, driven by the ongoing digital transformation in the sector and the growing demand for advanced dealership management solutions. Dealerships are likely to prioritize investments in DMS platforms that offer features such as cloud-based deployment, mobile accessibility, and integrated data analytics to support recovery efforts and capitalize on new growth opportunities. Additionally, the pandemic has accelerated trends such as online car buying and contactless transactions, further driving the adoption of DMS platforms that enable seamless digital experiences for customers and dealers alike. Overall, the post-COVID-19 period is expected to witness renewed momentum in the dealer management system market as automotive dealerships seek to leverage technology to navigate the evolving business landscape and drive future growth.

Key Players in the Global Dealer Management SystemMarket

The market players in the global dealer management system market are Wipro Limited (India), PBS Systems (Canada), Orange Mantra (India), Integrated Dealer Systems (US), Excellon Software Pvt. Ltd. (India), Evopos Ltd (UK), eMsysSolutionsPvt. Ltd. (India), e-Emphasys Technologies, Inc. (US), Dominion Enterprises (US), DealerBuilt (US), Damco Group (US), COX Automotive (US), CDK Global LLC (US), Bit Dealership Software, Inc. (US), andAutosoft, Inc. (US).

Key Developments

- In November 2023, Dominion DMS unveiled integration with Auto Pro Solutions.Auto Pro Solutions, LLC stands out as a leading provider of innovative solutions for the automotive industry. Auto Pro Solutions offers a variety of functionalities aimed at bolstering the performance of automotive enterprises, placing a strong emphasis on enhancing customer satisfaction and streamlining operations.

- In October 2023, The Reynolds & Reynolds Company and Proton Dealership IT jointly announced the completion of a state-of-the-art Security Operations Center (SOC) at Reynolds' Dayton, Ohio headquarters. This newly established SOC, now operational, signifies a major leap forward in the ongoing detection of illicit and questionable activities. Proton's vigilant security monitoring and response initiatives against cyber threats targeting dealerships throughout North America are heavily dependent on this SOC.This new security hub represents a fusion of Reynolds and Proton's capabilities, facilitating the delivery of expertise at a larger scale in service provision.

- In December 2022, Oracle and Tata Motors revealed the transition of the automotive firm's complete dealer management system to Oracle Cloud Infrastructure (OCI). The initiative aims to enhance Tata Motors' operational efficiencies, providing enhanced business insights, heightened security measures, improved flexibility, and optimized costs, as per an official statement.

Market Players

- Wipro Limited (India)

- PBS Systems (Canada)

- Orange Mantra (India)

- Integrated Dealer Systems (US)

- Excellon Software Pvt. Ltd. (India)

- Evopos Ltd (UK)

- Ltd. (India)

- e-Emphasys Technologies, Inc. (US)

- Dominion Enterprises (US)

- DealerBuilt (US)

- Damco Group (US)

- COX Automotive (US)

- CDK Global LLC (US)

- Bit Dealership Software, Inc. (US)

- Autosoft, Inc. (US)

Market Segmentation

By Component Segment

- Solution

- Services

By Deployment Type Segment

- On-Premise

- Cloud-Based

By Application Segment

- Sales

- Finance

- Inventory Management

- Dealer Tracking

- Customer Relationship Management

- Others

By End User Segment

- Automobile

- Agricultural & Forestry

- Construction

- Transportation and Logistics

- Mining

- Motor Sports

- Others

By Region Segment

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Netherlands

- Switzerland

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Indonesia

- Rest of Asia-Pacific (APAC)

- Middle East&Africa (MEA)

- Saudi Arabia

- UAE

- Rest of Middle East & Africa (MEA)

- South America (SAM)

- Brazil

- Argentina

- Colombia

- Rest of South America (SAM)

Interested in this report?

Dealer Management System Market Size and Forecast to 2030

TOC